The 11th Annual CBA Symposium: Connecting Communities

The Credit Builders Alliance (CBA) has a special place in Accompany Capital’s history. When CBA was created in 2008 – in our early years of lending – we had the distinct honor of being one of the founding members. As a result, we were able for the first time to help our clients establish an all-important credit history and credit score, which contributes to financial stability and opportunity in the form of credit for basics necessities, establishing a business, or purchasing a home.

In the last decade since its creation, CEO Dara Duguay and her team have taken CBA to another level. CBA Fund, the CDFI intermediary established by CBA, under the management of Brooke Cain and Keyonna White, has provided $5.5 million in small dollar consumer loans and $1.54 million in grants to over 44 unique organizations.

This month over 350 nonprofit financial coaches, financial educators, partner organizations, non-profit leaders, government agencies, credit reporting agencies, fintechs, regulators, Tribal Entities, and allies – fundamentally anyone with a commitment to increasing credit access to those that need it – were in attendance for the CBA’s 11th annual symposium in Washington DC. This year’s theme was Connecting Communities Through Credit, and after a warm welcome from CBA Board Chair Donovan Duncan of Urban Strategies Inc., the symposium was off to a great start.

Keynote Speaker, Economist & writer Jeffrey Fuhrer, author of the book The Myth That Made Us, highlighted the importance of questioning the status quo. He made a compelling argument, with evidence from other developing countries, that we need to rethink the economic systems that have shaped the US economic system that favor doing little to reduce the disparities in our communities.

We were equally inspired by social entrepreneur Samir Goel, cofounder of Esusu, with his business partner and fellow immigrant, Wemimo Abbey. Esusu is now the leading technology platform in the US enabling rent reporting, rich property management analytics, and rental assistance while unlocking financial access and stability for renters and property owners alike. Goel thanked CBA for inviting him to speak when he was first establishing the business and shared that it was the financial struggles that his family faced when they first came to the US that motivated him to establish a company like Esusu.

Panel discussions were on topics that ranged from traditional financing to Islamic Financing, rent reporting, and safe and affordable small dollar loans. One of the panel discussions that was particularly relevant and interesting for us at Accompany Capital addressed assisting refugees to establish credit through the critical consumer loans that they need to cover costs of starting a new life in the US, with Joshua Geary and Aran Teeling of Center for Economic Opportunity, the CDFI associated with IRC; Abby Wahl of IRC; and Chris Warman, Program Officer at the Baltimore Community Foundation.

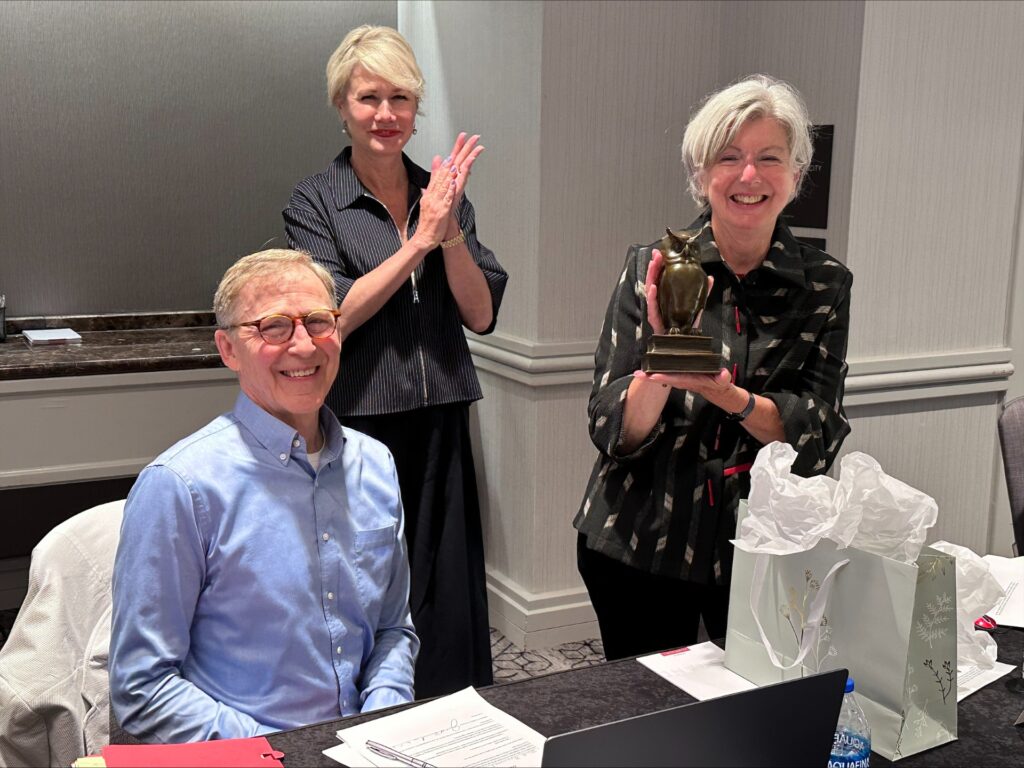

There were also several moments to celebrate! Congratulations to the three winners of the 2024 Karen Dabson Awards: Maria Sigalas of IRC, Bonnie Wallis of Wells Fargo, and Yolanda Huillca of CEDS Finance.

The CBA board also honored long time board member Jeanne Hogarth for her dedication and guidance.

Accompany Capital was represented this year by Executive Director Yanki Tshering, who is on the board of the CBA Fund and serves as Chair of the CBA Fund’s Consumer Loan Fund, as well as by Tsetan Dekyi, who was attending for the 3rd time; Roberto Evans, who has been a Master Trainer in credit counseling since 2021, and Cristina Garcia, a first-time attendee. Thinking about her experience, Christina shared: “As a first-time attendee of the CBA Symposium it has been an amazing experience! From the FICO bootcamp where I was able to learn more about the FICO credit scoring system to learning how we can use behavioral science to add friction for positive results. Being able to meet other people in the same industry but in different states was also an incredible experience. I was able to learn, understand and think in a bigger capacity to make a positive impact in the communities that may need it the most.” Roberto noted: “Being part of an organization that has modified loan products to fit a clients’ cultural background, I found the session on Islamic Financing very useful in how to better craft Sharia-compliant financial products for clients that request it. I’ve enjoyed attending the last several years and always find something useful to bring back to our staff and clients.” Tsetan, in turn, cited the “Leveraging Behavioral Science to Manage Loan Repayment, Build Credit, and Strengthen Communities” session as having particular value for her, noting: “I gained insights into ideas42’s application of behavioral science to develop solutions for repayment issues. I have identified actionable steps to bring back to our team, with the potential to implement some of these strategies.”